Introduction

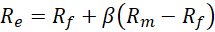

In the blog on Equity valuation, we talked about CAPM ( Capital Asset Pricing Model ). The CAPM provides the theoretical framework for computation of the cost of equity (Rₑ) .

The risk and return are the two sides of the same coin. We cannot talk meaningfully about the return from the project without discussing the risk associated with it in the same breath. What do we mean by risk? The risk is the uncertainty associated with the company’s performance and therefore the returns to be expected by the investor. If you were to invest in a 10-year Treasury Bond from RBI, the returns are guaranteed and is denoted as the risk-free rate of return. The interest payable on a treasury bond is guaranteed by the Government of India and therefore the risk of default is zero. No other form of investment enjoys the same status. The uncertainty or volatility associated with the return on investment is the risk.

We all are aware of the risks associated with an investment in the stock markets. Why then do investors invest in stocks and what is the incentive for it? The investors are saying that we are aware of the risks associated with this investment and as long as you provide returns that are commensurate with the risks ( read “risk premium”) ,we are fine with making the investment. The Management of a company must therefore deliver returns that are more than or equal to the “Required rate of Return” (RRR = cost of equity) specified by the investors. The RRR can be derived from CAPM. If the Management of a company are not delivering an ROE that is in excess of the Rₑ, they are destroying the value for the investors. The company may deliver stellar returns in absolute terms but if it does not measure up to the investor expectations, then the investors will dump the stock leading to a price correction in the market. We see that often in the market where a company has declared a decent quarterly results but the stock corrects. It could be due to the company not meeting the investor expectations among other things.

Quick recap on CAPM: Cost of Equity (Rₑ)

The expected or required rate of return that shareholders demand for investing their money in the firm. It’s a forward-looking measure, used in valuation and investment decisions.

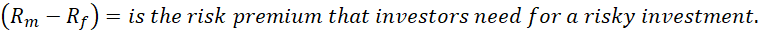

The CAPM basically says that the return on investment in a firm comprises of two parts – a risk free rate of return which is the interest an investor earns on a long-term Treasury bond ( 10 -year bond) and a risk premium multiplied by the relative risk of the stock in comparison to a well-diversified market portfolio.

Rₑ Estimated using the CAPM (Capital Asset Pricing Model):

Where:

= Risk-free rate (e.g., yield on government securities)

= Expected market return

= Measure of the firm’s risk relative to the market

Meaning:

“How much return do investors expect as compensation for the risk they take

Used in WACC to discount cash flows to evaluate projects.

CAPM

Before we proceed further, it is important to ensure that we have a good understanding of CAPM and its significance in equity valuation.

The fundamental principle behind CAPM is that the investors need to be compensated for the risk that they assume when they invest in a stock. The risk or uncertainty of revenue streams or volatility is of two types – one is specific to a company and the other is the economic risk. The company specific risk could be from the inefficiency of the Management team, lax corporate governance standards or it could be due to the challenges inherent in the sector that they are operating in. Let us say, you have invested in an oil PSU that buys Crude from the international markets, refines it and markets it to consumers. The crude oil prices fluctuate on a daily basis. The oil marketing PSU therefore report highly fluctuating GRMs ( Gross Refining Margins) from Quarter to Quarter. As an investor you may not want to put up with this volatility. You can invest in a large cap MF for stable returns. But the economic risk cannot be wished away.

You can reduce the company specific risk through diversification but even a well-diversified portfolio cannot escape the economic risk that comes with making an investment in a country. The economic growth is a function of the fiscal and monetary policies of the government. How then do we measure the economic risk? We don’t have to estimate the economic risk. Since the economic risk is something that cannot be wished away, we can devise a relative measure of risk which measures the volatility of a stock w.r.t to the volatility of a market portfolio ( proxy for the economic risk).

Let us say you have a well-diversified portfolio of stocks – say an ETF based on SENSEX or NIFTY 50. The return from this market portfolio, let us call it as .

We can also compute the volatility of a given stock say ITC and also compute the volatility of the market portfolio.

= Measure of the firm’s risk relative to the market = Covariance of returns of ITC with respect to the returns of the market portfolio.

| Company | Beta | Risk Premium (Rm – Rf) | Cost of Equity (Rf = 6%) |

| Mature Utility | 0.7 | 8% | 6 + 0.7(8) = 11.6% |

| High-growth Tech | 1.6 | 8% | 6 + 1.6(8) = 18.8% |

A power utility for example, delivers stable revenues and returns YoY. A company that operates in AI, for example, has a much higher beta and therefore the cost of equity is way higher.

How do we apply CAPM for valuation and investment decisions?

We have already done the hard work of estimating the cost of equity – the return that investors need or demand to invest in a firm or a stock with a given risk – Rₑ. A firm is most likely funded in part by equity and partly by debt. We have to therefore arrive at the WACC ( Weighted Average Cost of Capital) to compute the cost of the invested capital.

The organisations need to constantly invest in new products or services. How do we ensure that the new investments are value accretive and not value destructive. The WACC becomes the benchmark rate for investment decisions. The present value of all the future cashflows from an investment discounted at the rate of WACC must be greater than or equal to the investment cost and in that case an investment is a value creating investment and is value destructive otherwise.

Return on Equity (ROE)

The ROE is a historical measure of profitability. It is also very insightful to compare it with the Rₑ – the Required Rate of Return on Equity capital or the cost of equity capital.

- If ROE > Cost of Equity → The company is creating value for shareholders.

- If ROE < Cost of Equity → The company is destroying value.

- If ROE = Cost of Equity → The company is just meeting investor expectations

This what drives the share prices. An absolute measure of ROE might be very good but if it falls short of Market expectations ( Rₑ), then the investors will dump the stock as it falls short of their expectations.

Summary

The Management of a company is accountable to the shareholders to deliver value in line with their expectations. All their investment decisions must pass the test that the Net Present Value of the proposal must be greater or equal to zero when discounted at the rate of WACC. If they don’t find investment opportunities that meets this criterion, then the money must be distributed to the shareholders.