Introduction

In order for organisations to grow, we have to constantly invest in new products and projects to generate additional revenue streams. Investment in new projects and programs becomes all the more important when you observe the shrinking product lifecycles and emergence of new business models all the time. Investments in new products, investments in new plant and machinery and additions to installed capacity are needed to stay ahead. But then we are all presented with multiple opportunities in front of us and the question becomes one of choosing the right opportunity to pursue. We have to therefore choose the most meritorious opportunity to invest on. Due to resource constraints, it is not feasible to take up all the projects that may seem attractive. We have to therefore draw up a merit-order of project with the most attractive being at the top and the least attractive being at the bottom. The question is on what basis that we draw up the merit order of projects?

There are any number of project evaluation methodologies available in the literature. The simplest one being the payback period. The payback period simply denotes the number of years that it takes to recoup the investments. It is a very intuitive and simple method to understand and apply but its main drawback is that it does not take into account the Time-Value of Money (TVM). If you are not familiar with the concept of TVM, please read the section on TVM that is being covered in the later paragraphs.

The other popular methodology is the IRR (Internal Rate of return) methodology. It does take into account the time value of money. The IRR is the discount rate at which the inflows are equal to the outflows. While it is mathematically very elegant, it makes an implicit assumption that there will be re-investment opportunities equal to the IRR. This may not be always valid especially when the IRR is very high. And when we have multiple projects for evaluation, selection of a project purely based on IRR ignores quantum of value each project creates.

The Net Present Value (NPV) methodology is a very robust evaluation methodology. The NPV methodology helps us to choose a project or a program that creates the maximum value for the shareholders. As Managers acting on behalf of the shareholders, we have to select a project that creates maximum value for the shareholders. The application of NPV ensures that the investment decisions are value accretive and not value destructive. The NPV methodology has its application in many areas of Financial Management. NPV framework can guide us on make or buy decisions, dividend policy, valuation, M&A and many such areas of Financial Management and it is not just restricted to Capital Budgeting.

Net Cash Inflows and not accounting profits

In order to evaluate the investment projects, we must consider the project cashflows over the life of the project. Most of the real-life projects have multi-period cashflows. For example, consider the cashflows of the three projects given below – Project #1 , Project #2 and Project #3.

The steady-state cashflows of Project #3 is much higher than Project #1 & #2. Should we select Project #3 over Project #1 & #2? We will revisit this question after we have covered some ground on Time Value of Money and Net Present Value.

Time value of money

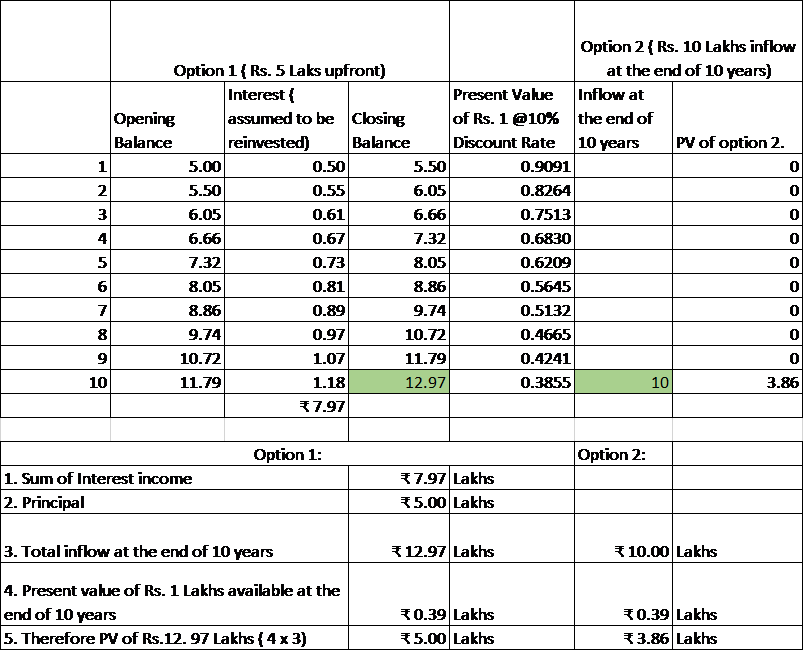

Not all cashflows are born equal. If someone were to pay you Rs. 10 Lakhs after 10 years or Rs. 5 Lakhs right away, what should you opt for? What will create more value for you assuming that you have an opportunity to earn 10% return on your investments. Risk and return are the two sides of the same coin. When we talk about return, we also have to discuss the riskiness of that investment. But for now, we will assume that you have an opportunity to earn a return of 10% on a well-diversified market portfolio, say an ETF linked to Sensex.

If you were to choose receiving Rs. 10 Lakhs payment at the end of 10 years, you are forgoing an opportunity to earn 10% return on Rs. 5 Lakh that you would have received today. Had you opted for Rs. 5 Lakhs, you would be left with Rs. 12.97 Lakhs at the end of 10 years.

The Net Present Value (NPV) of Option 1 and Option 2 are Rs. 5 lakhs and Rs. 3.86 Lakhs respectively. When we consider the Time Value of Money, Option 1 turns out to be better.

The Discount Rate

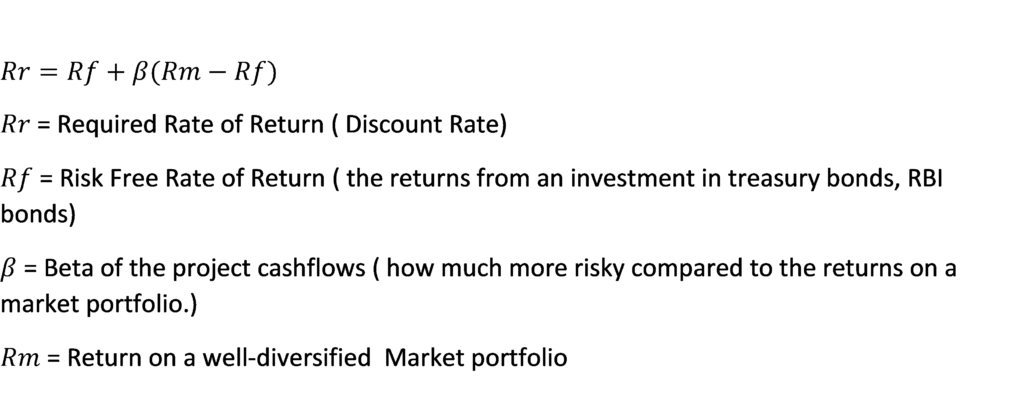

The selection of the Discount Rate ( DR) is an important step in project appraisal. The companies normally use the Weighted Average Cost of Capital (WACC) for discounting. This is fine so long as the projects being evaluated have the risk profile similar the cashflows of the company.

If the risks of the projects being evaluated are substantially different from the risk profile of the company evaluating the projects, say in the case of unrelated Diversification, then the DR is better chosen using the Capital Asset Pricing Model.

The CAPM will not be discussed in detail here.

The NPV model in action

Now let us say, we have evaluate the following three projects based on NPV model. Let us assume that the OCC or DR is 12%.

More generally, the NPV rule can be stated as follows:

The project NPV must be greater than zero for it to be eligible for selection. Among all the projects that have a NPV > =0, choose the ones that have the highest NPV.

The NPV of Project #3 is < 0 and therefore is rejected from the zone of consideration. Between Projects #1 and #2, the NPV of Project #1 > NPV of Project #2 and therefore Project #1 is considered for investment.

Summary

NPV is a very powerful concept that has its applications in many areas of Financial Management. If you would like to learn about Financial Statements and Valuation, please give us a call.

For comments and feedback, write to

Madan Mohan Raj, athimoolam.madan@gmail.com, Partner, Centre for Executive Learning. https://execedonline.co.in/