Introduction

As an ordinary investor we have several avenues for investment – Bonds, Equities, Real Estate etc. Of all the investment avenues, equities probably present the most favourable risk-return trade-off. Investing in equities is essential for long-term wealth creation and if done right, will ensure our financial independence in our golden years.

How do we go about selecting the stocks to build our portfolio? The one question that troubles us all is the valuation conundrum, how do we know if the stock is fairly valued?

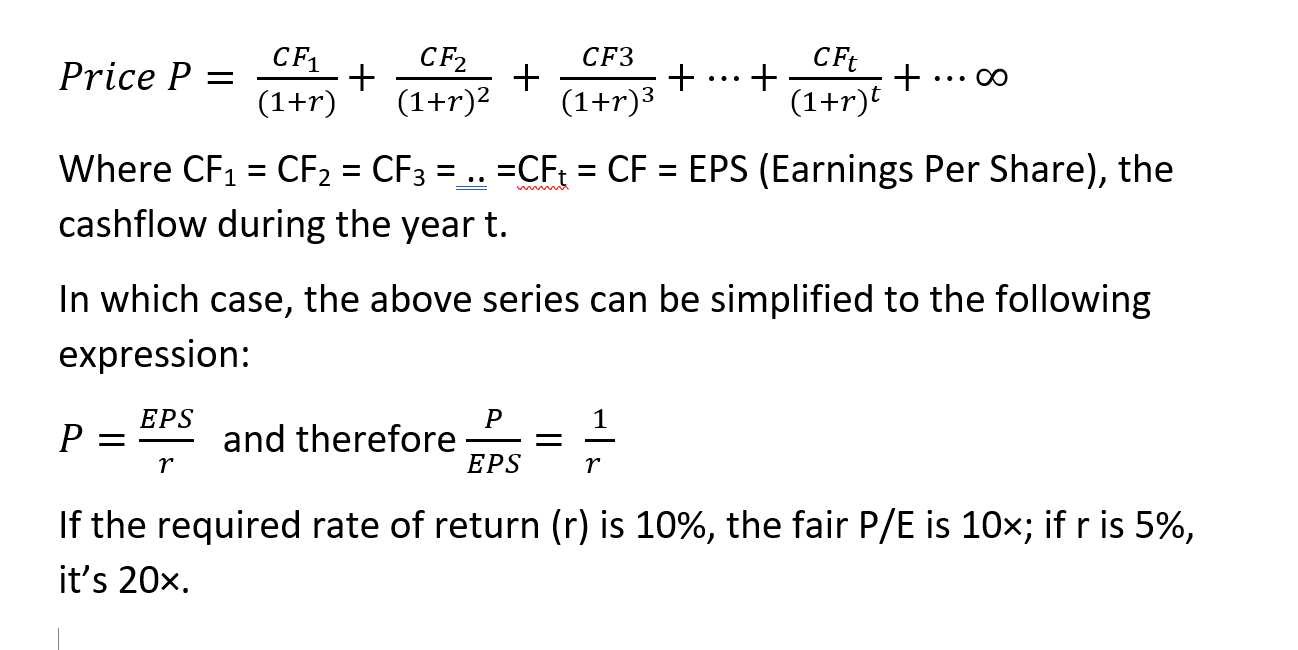

Price – Earnings Multiple

PE ratio – If you are an equity investor, you might have come across this term quite often when watching a business channel or reading a financial daily. Have you always wondered what makes people to shell out 40 or 50 times the current year earnings to buy a stock?

I have mostly been guided by the future cashflows of a firm before deciding to invest or not. In my view, the estimated future cashflows are the only reliable indicators of the value of a stock. For that matter any investment we make, must justify itself from this yardstick.

Many companies declare bonus shares, stock splits and share-buyback to shore up the stock prices. None of these gimmicks add any real value to the firm. Share-buyback shows that the company has run out of ideas and don’t have new projects to invest on. When done in extremes, the company will be left to rue its decision sooner than later.

What is a fair value for a stock?

An equity investment or a capital asset is worth only as much as the discounted value of future earnings. Assuming that you are buying an MRI machine for your hospital, you will need to ensure that the discounted value of the future earnings from the equipment must be more than the investment outlay. If the present value of future cashflows is lesser than the cost of acquiring that machine, you are not adding value to the firm but destroying it.

Net Present Value method of valuation.

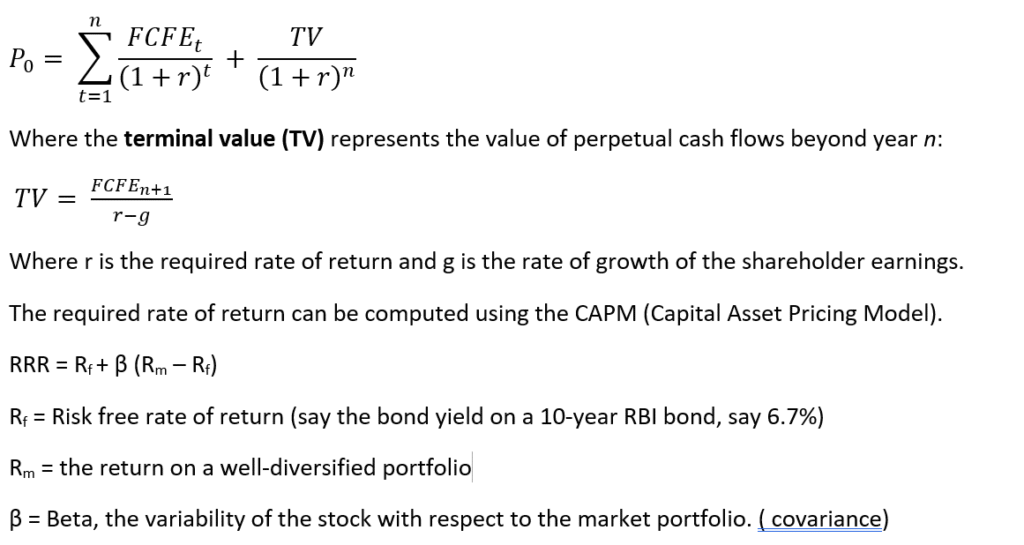

The NPV is a great tool to evaluate any multi-period investment or a project. How do you evaluate competing investments that deliver earnings over many years? When we talk about future earnings, we have to bear in mind that there is some element of uncertainty on the returns as well, unless you invest in a government bond (Treasury bonds issued by the RBI or in the global context the Treasury bonds issued by the Federal Reserve). In order to compare two multi-period investments, we need to ensure that the cashflows from the projects are brought to a same common level or what we call as present value. The rate of discounting must reflect the opportunity cost to the investor – the return forgone by an investor on a project of similar risk. (Please read my blog on Capital Asset Pricing Model (CAPM) for an explanation on the Opportunity Cost of Capital).

The NPV is a great tool that all of must employ to ensure that any financial decision we make that involve multi-period cashflows is a value creating decision and not a value destroying decision. It is a misconception to assume that the NPV has its applicability only for carrying out the financial appraisal of competing projects. It can be applied in a variety of situations to choose from different alternatives especially when there are risk and uncertainty involving future cashflows.

The NPV basically says that not all cashflows are equal – Rs. 10 Lakhs (1 million Rupees) that you have today is not the same as Rs. 10 Lakhs available to you one year down the line. The reason is very simple – you have several promising investment opportunities available to you today to park your funds.

If you had Rs. 10 Lakhs with you today, you could have invested in an RBI bond (risk-free) and earned say 6% interest on it. If you were to receive Rs. 10 Lakhs of Rupees one year down the line, you know it is worth a lot less at the present moment (= Rs. 10/(1+r) = Rs. 9.43 Lakhs) where r is the Opportunity Cost of Capital (OCC). This is the basis for NPV, the future cashflows have to be discounted by the OCC to allow for the opportunity foregone. The only thing that one needs to remember is that the choice of the discount rate must be done carefully (more of that later). The OCC tends to vary from investor to investor and his risk inclination.

Equity Valuation

Now that we have covered some ground on NPV and multi-period cashflows, we are now ready to look at equity valuation. There are several models of equity valuation is available to us but we will stick to NPV model of valuation.

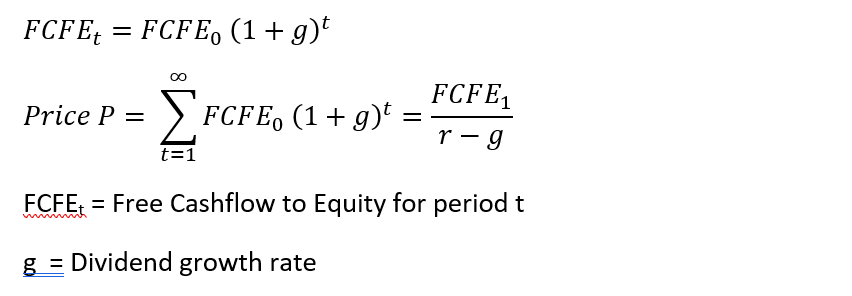

When it comes to valuing a stock, what are the relevant cashflows that we must consider? One obvious cashflow is the dividend stream from the stock but the problem is not all companies declare dividends consistently and those who declare dividends may not share all the available surplus. We would therefore consider FCFE (Free Cashflow to Equity) streams for valuing an equity. The FCFE is all the cashflow available to a common stock holder after operational expenses, capital expenses and net debt payments. For a comprehensive review of all the different models of Equity valuation, please refer to my blog on Equity Valuation Models.

Perpetual Revenue Stream

We will now compute the value of a stock assuming that the company will deliver the same shareholder return over the coming years perpetually. You might say that this is not feasible – economic cycles, competition etc. will mean that the shareholder returns are anything but stable. The only reason we are making this assumption is that the algebra gives us a neat solution for computing the Price but when you apply this formula in real world, you must be mindful of its limitations.

Perpetual revenue stream with growth

The limitation with the model we discussed above is not only about perpetuity of revenue streams but it also assumes that the revenue will stay constant all through its life. This is a serious limitation. We will now assume that the revenue stream grows at constant rate of “g” over the life of the firm.

The growth rate must be chosen carefully – 2 to 4% may be a reasonable number. In any case, it must not exceed the GDP growth rate.

If the stock follows a high-growth path for the period under forecast, then it maybe useful to split the dividend streams into two parts. For the forecast period, say 5 years, the growth rates can be high and thereafter it can fall back to more reasonable levels.

Now that we have all the parameters needed to compute the theoretical PE for a stock and it might be useful to see how it compares with a real-world PE.

In an efficient market, the real-world PE should equal to the theoretical value but we know that the market is anything but efficient but still a theoretical framework helps us to remain grounded.

Note: The CAPM is a very important concept in Finance but we have only mentioned it in the passing. Please wait for my future updates on CAPM. Happy investing.